|

|

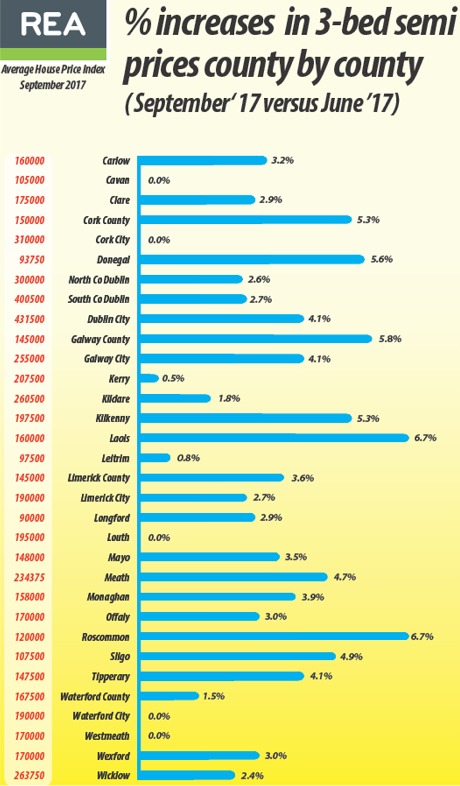

Donegal house prices amongst

cheapest in Ireland

26.09.17

DONEGAL remains one the

cheapest counties in Ireland to purchase a home,

despite a 5.6% rise in the price of the average

three-bed semi in the last quarter, according to a

national survey carried out by Real Estate Alliance.

The REA Average House Price Survey concentrates on

the actual sale price of Ireland's typical stock

home, the three-bed semi, giving an up-to-date

picture of the property market in towns and cities

countrywide to the close of last week.

Despite the absence of sterling buyers because of

Brexit and the exchange rate, prices in some parts

of county Donegal have risen by an average of €6,250

since June, fuelled by an acute lack of supply of

suitable properties. |

|

This lack of supply has

seen prices in Bundoran rise by €10,000 or 11% in

the last quarter.

However, Donegal (€93,750) is still among the only

three counties, Longford (€90,000) and Leitrim

(€97,000), where properties can be still be

purchased for a five-figure sum.

“Brexit and the resulting exchange rate has reduced

the number of sales to sterling-based clients. What

is more, we see this situation continuing for the

foreseeable future,” said Michael McElhinney from

REA McElhinney in Bundoran.

In Milford, there is good demand for three-bad

family home, but the lack of supply is still an

issue, according to Paul McElhinney from REA

McElhinney in the town.

The average semi-detached house nationally now costs

€221,843, the Q3 REA Average House Price Survey has

found – a rise of 3.1% on the Q2 figure of €215,269.

Overall, the average house price across the country

has risen by 11.2% over the past 12 months – just

under twice the 6% increase registered to the full

year to September 2016.

The average three-bed semi-detached home in Dublin

city has jumped in value by €17,000 in the three

months to the end of September, and now costs

€431,500.

The 4.1% rise over the last quarter means that

prices in the capital’s postcode areas have

increased by 15.6% over the past year, with

properties selling in an average of four weeks after

hitting the market.

“Supply is the main driver of these continuing price

rises with our agents reporting that the volume of

listings is down around the country,” said REA

spokesperson Healy Hynes. |

|